“Beware the Ides of March” – Soothsayer, Julius Caesar, Act 1 Scene 2

While we are still a few days away from the actual Ides of March, this month’s market volatility seems to echo the Soothsayer's ominous warning to Caesar.

In March’s defense, volatility began in late February with the University of Michigan's consumer sentiment survey plummeting to its lowest point since November 2023. This data, however, revealed a stark partisan divide, with Republican sentiment stable while Democratic and Independent sentiment sharply declined.

As February drew to a close, a cascade of disappointing economic indicators were released: waning consumer confidence, soft January retail sales, and a surge in initial jobless claims - all fueling fears of a consumer spending slowdown. While a single month's data doesn't define a trend, sentiment and initial jobless claims are recognized as leading economic indicators, raising questions about the economy's resilience in the face of potential disruptions caused by President Trump's economic agenda.

Then came the barrage of news from Washington. President Trump reiterated his 25% tariffs on Mexico and Canada, then delayed a majority of them, and is now threatening additional tariffs on Canada. A heated meeting between President Trump and President Zelenskyy of Ukraine has caused Europe to reevaluate it’s role in providing for it’s own defense with enormous geopolitical and economic implications. Meanwhile, Elon Musk’s DOGE team has continued to make headlines as it works its way through government departments.

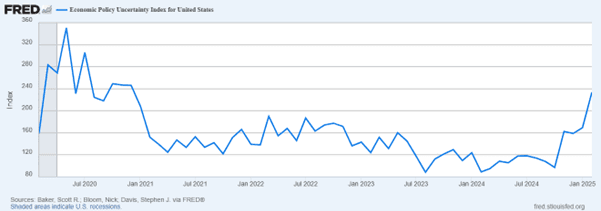

The administration’s volatile tariff and foreign policy, combined with the ambiguous endgame to DOGE’s efforts, has generated significant market uncertainty. And if there is one certainty about markets, it’s that markets hate uncertainty. Companies are struggling to plan orders and capital investments amidst shifting trade policies. Consumers are trying to grapple with the potential impact on their jobs and what trade policies will mean for prices. Indeed, the Fed’s Economic Policy Uncertainty Index (monthly) has now climbed to it’s highest since 2020.

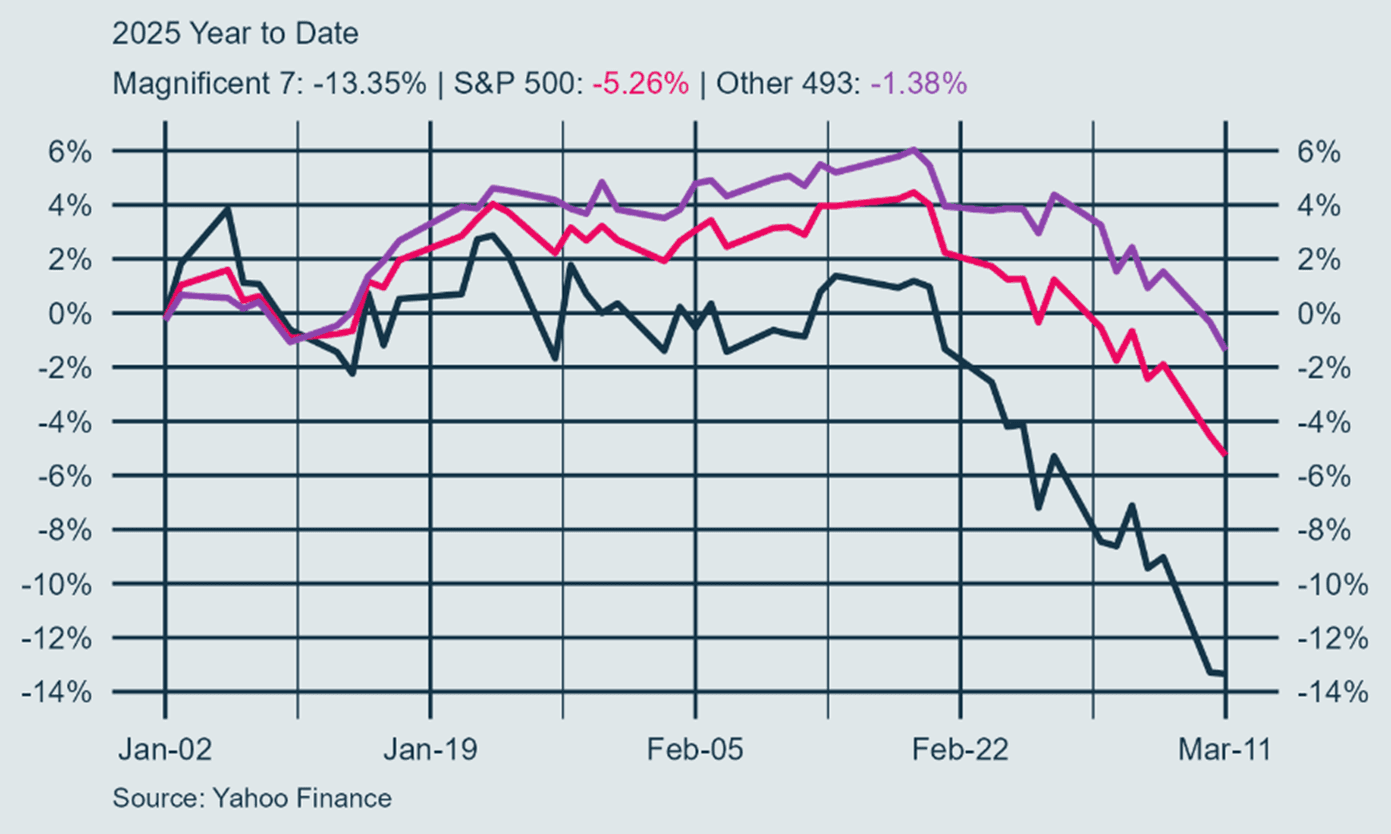

All this unfolds against a backdrop of historically high market concentration and valuations in the major US indices. As previously discussed (link), volatility is amplified when major indices are dominated by high-valuation companies. Indeed, as of market close on Tuesday, the S&P 500 is down just over 5%, with the Magnificent 7 down over 13%. The rest of the S&P is down less than 2%.

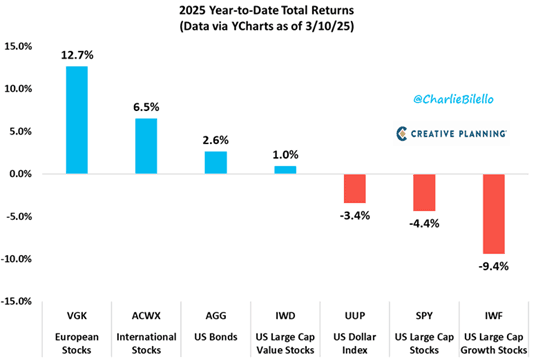

In this environment, a diversified portfolio has proven its worth. Bonds have provided their intended diversification benefits, international equities have outperformed (largely due to US policy implications), and value/defensive stocks have surpassed growth stocks.

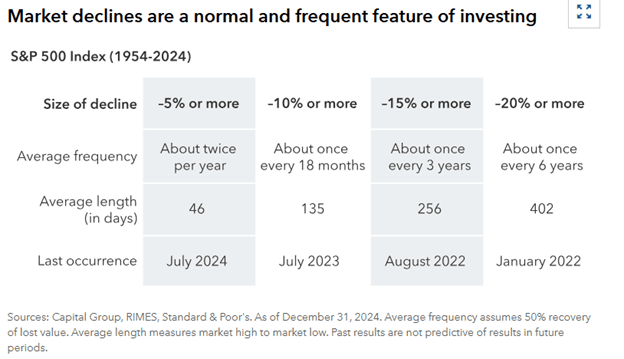

Given the market's elevated valuations and concentration, a correction was inevitable. Markets tend towards mean reversion, though they require a catalyst. It's also worth remembering that 5-10% drawdowns, while uncomfortable, are a regular feature of the market.

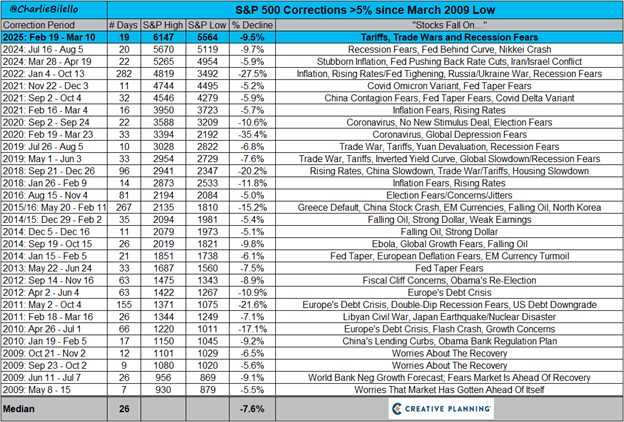

In this current moment, if market valuation/concentration was the kindling, policy uncertainty is the fuel and President Trump lit the match. Every market drawdown has some combination of kindling, fuel, and ignition. Charlie Bilello, from Creative Planning, put together a great chart of every decline greater than 5% since the Great Financial Crisis, along with “why” those pullbacks happened. It’s interesting to look back on some of those events and think about the uncertainty, fear, and the “this time is different” thoughts they caused.

This episode, like those preceding it, reinforces the need for thoughtful diversification, regular rebalancing, and most importantly – ensuring your portfolio is designed to achieve your goals rather than chase trends. While we cannot predict the timing or cause of market corrections, we can build portfolios prepared for their inevitability. Like Caesar, we cannot claim we were unwarned. "The fault, dear Brutus, lies not in our stars, but in ourselves."

Investment Management

A Big Night for Republicans. A Big Day for Equities.

A Big Night for Republicans. A Big Day for Equities.

Our wealth management advisors can help you with our comprehensive suite of services designed to help you achieve your financial goals. Contact us today and let's start building your financial future.